In the ever-evolving landscape of online commerce, the need for secure, convenient, and flexible payment solutions has never been greater. Klarna, a Swedish fintech powerhouse, has emerged as a key player in this space, reshaping the way we shop online.

-

Buy Now, Pay Later (BNPL): A standout feature of Klarna is its Buy Now, Pay Later (BNPL) model. This allows users to make a purchase and defer the payment, often splitting the total amount into manageable instalments. This flexibility empowers consumers, making higher-value items more accessible and budget-friendly.

-

The Checkout Process: Klarna has redefined the checkout experience. When a user selects Klarna as their payment method, they are prompted to enter minimal information. This user-friendly approach significantly reduces the steps involved in completing a transaction, leading to higher conversion rates and lower cart abandonment.

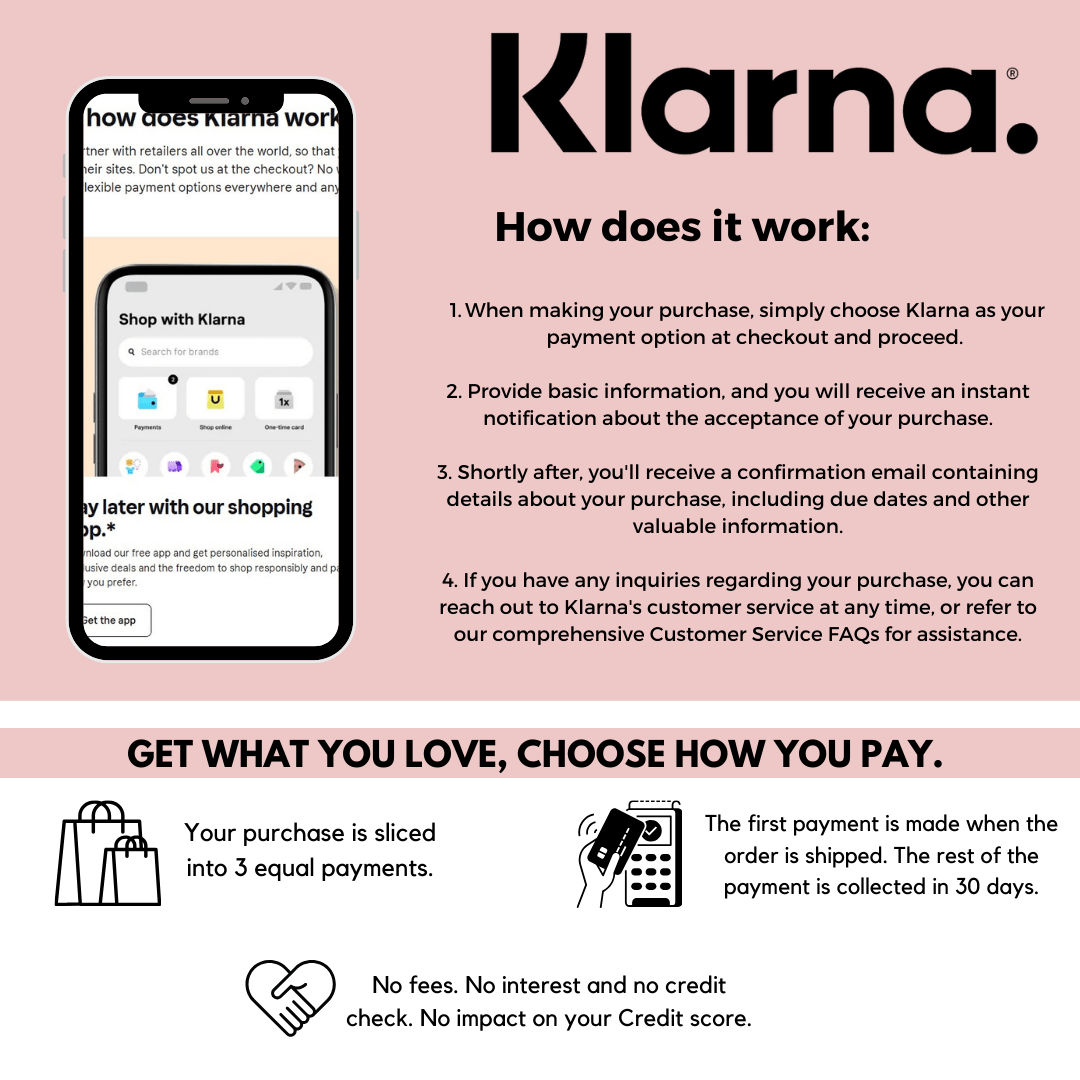

How it works:

- When making your purchase, simply choose Klarna as your payment option at checkout and proceed.

- Provide basic information, and you will receive an instant notification about the acceptance of your purchase.

- Shortly after, you'll receive a confirmation email containing details about your purchase, including due dates and other valuable information.

- If you have any inquiries regarding your purchase, you can reach out to Klarna's customer service at any time, or refer to our comprehensive Customer Service FAQs for assistance.

GET WHAT YOU LOVE, CHOOSE HOW YOU PAY.

- Your purchase is sliced into 3 equal payments.

- The first payment is made when the order is shipped. The rest of the payment is collected in 30 days.

- No fees. No interest and no credit check. No impact on your Credit score.